The lending industry has seen a sea of change in the last few years. Fintechs have an ever increasing portfolio, while traditional lenders have had their client bases shrink. Although the interest rates with fintechs is significantly higher than it is with regulated lenders like banks and NBFCs, they have proven to be more successful in growing their loan books.

The key difference between the two is turnaround time of disbursement, which has been reduced from hours or days to seconds in some cases with the help of digital underwriting. While traditional lenders take anywhere from a few days to a few weeks, Fintechs are able to achieve turnaround times measurable in hours if not minutes.

This is simply due to the fact that, keeping up with the times, Fintechs have adopted decision engines over traditional risk analysts. They have leveraged the power of digitisation to their advantage in order to reach a wider and more robust market, while eliminating the paperwork involved.

How does the decision engine work and what are its key components? How does it help turnaround time? How does it affect profitability? These are some of the common questions around decision engines. Here we will try to answer a few of them.

How does a Decision Engine affect turnaround time?

In a traditional lending business, the process to assess the credit worthiness of a borrower involves lengthy, tedious, and cumbersome paper based processes. The borrower first needs to apply for credit and supply relevant proofs of information, such as PAN card and Aadhar Card copies, along with bank statements, cash flows and more.

The acquisition of this information can, in some cases, take days or weeks. This already lowers the satisfaction level of the borrower. But even after this, the lender is now faced with the challenge of verifying the provided data against relevant databases and to acquire further documentation like credit history and credit scores, and an assessment of credit risk. This step adds a further few weeks to the entire process and the already strained relationship between the lender and the borrower is put under more stress.

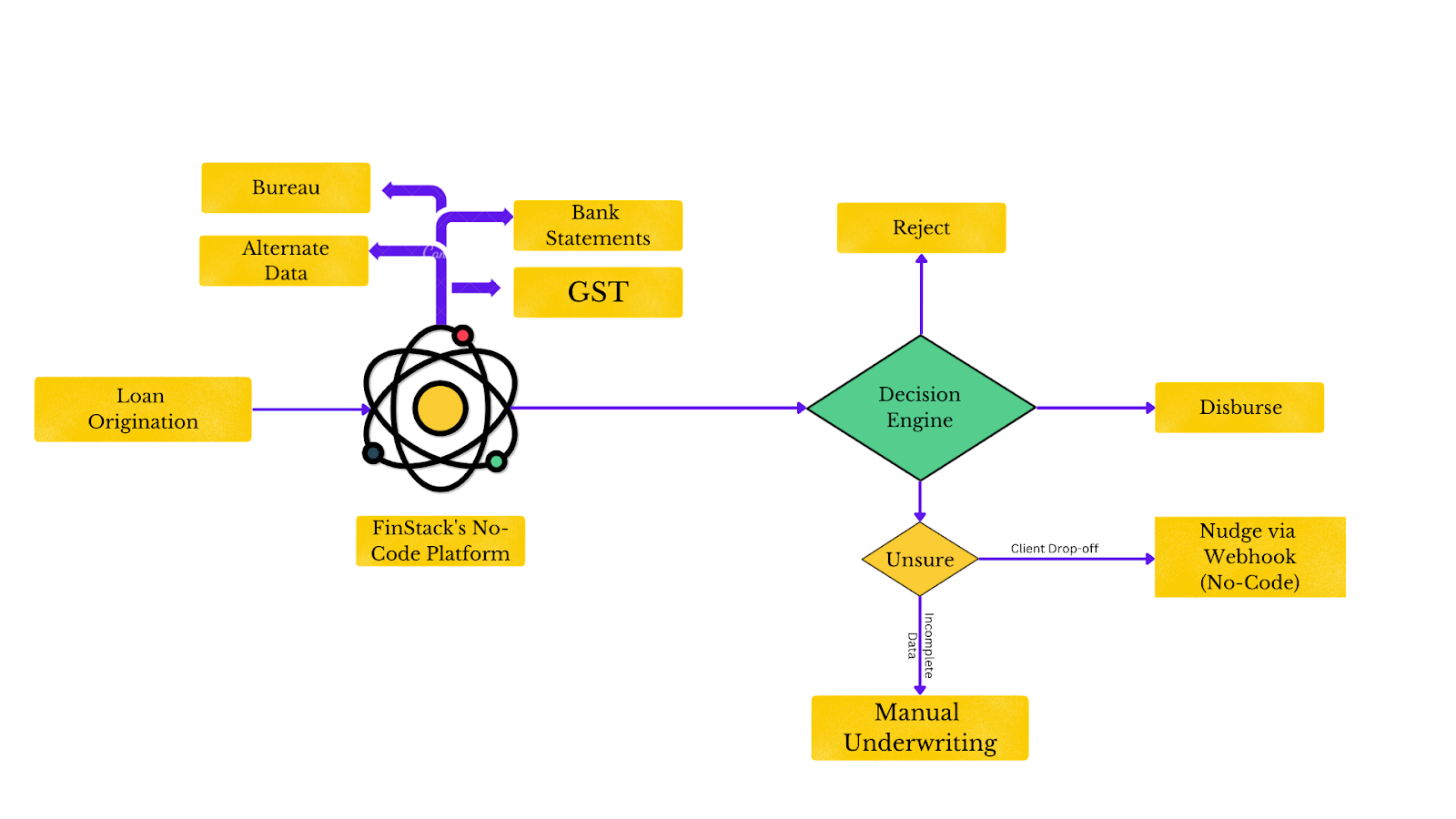

A decision engine takes the entire process online. It gets rid of the requirement for any paperwork or documentation, by directly communicating with relevant parties to acquire the data it needs.

This takes down the acquisition time from weeks to seconds. Then it assesses the creditworthiness and risk on the fly, based on the rules set forth by the lender, and arrives at the same decision within minutes.

Overall, a strong decision engine can reduce the turnaround time a lender needs from a few weeks to a few minutes.

What makes a Decision Engine and how does it work?

A decision engine is a business rule engine, where the various underwriting parameters and criterias can be configured instantaneously and applied on every single borrower.

Apart from standard rules, such as pincodes, age, bureau score, etc; a decision engine can support complex data points such as:

These factors and rules are entirely customizable and can be modified to fit the lender’s policies, and with FinStack’s proprietary decision engine, any changes regarding the rules can be made, deployed and tested in real time.

Now the next question, how does the decision engine acquire the aforementioned data? By requesting the data from relevant sources, such as credit bureaus, UIDAI, account aggregators and so on, which have readily available API integrations within the FinStack Ecosystem, allowing you to request and acquire the necessary data within seconds.

| Traditional DE | FinStack DE | |

|---|---|---|

| Custom Variables | Limited variables | 600 out of box + support for custom variables |

| Data Integration | Separate Integration required (eg. Bureau, GST, KYC, etc) | Pre-integrated, along with analysed models and unique scoring models |

| Real Time Testing | Does not support real time back testing | Gives real time estimate of disbursal rate and default rate |

| Effect on Underwriting | Does not improve underwriting | Automatically suggests improvements in policy |

| Modularity | Non modular | Completely modular with support provided for LMS integration |

| Additional Capability | Only supports decision making | Allows for creation of user journey with configurable user nudges and webhooks |

Effect of a Decision Engine on Profitability.

As mentioned above, a decision engine eliminates a lender’s procedure of all middlemen. By directly communicating with the borrower and the documentation authority, the decision engine can make an unbiased decision based on correct and up-to-date information, reducing the risk of bad loans.

Also increasing profitability is the fact that the team of risk officers needed to assess a borrower can be reduced to as few as 2-3 professionals, in the event that a decision engine needs further support to assess an application.

Conclusion

A decision engine is key to ensure growth in today's market conditions. Integrating FinStack’s robust, customizable decision engine on your lending platform will increase customer satisfaction by decreasing turnaround time and improving decision making efficiency.