Scale Based Regulations

On the 22nd of October 2021, The Reserve Bank Of India released the scale based regulations structure

to classify and govern NBFCs registered in India.

According to the release, NBFCs in India

will be Classified in the Following 4 categories depending on the impact on the Indian economy:

The classification is based wholly and solely on the assets under management of each NBFC.

CLASSIFICATION NORMS

The TOP LAYER is to be empty ideally. This is to ensure that no NBFC can cause any severe impact on

the economy. NBFCs that may be classified in this layer are moved up from the upper layer on the

discretion of the RBI for more stringent regulations and scrutiny.

The UPPER LAYER has the top

16 NBFCs based on their AUM and RBI’s scoring parameters. NBFCs in this category are required to

maintain a Common Equity Tier 1 CRAR of at least 9%. Apart from this, they will be subject to leverage

and differential standard asset provisioning requirements to ensure quality of capital

held.

The MIDDLE LAYER will consist of NBFCs classified as under any of the following

categories:

The BASE LAYER will consist of all other NBFCs

Apart from the above, classification will be done based on the activity carried out:

CLASSIFICATION NORMS

The release envisions a glide path to increase the minimum net owned funds from their current

minimums to a minimum of 10 Cr. by March 2027. This is applicable to ICC, MFI, Fctors. While in the

case of P2P, AA and NBFCs not availing public funds with no customer interface the minimum will

continue to remain at 2 Cr. It also states that there will be no change in the minimums in the cases

of IDF, IFC, MGCs, HFC, and SPD. The release has changed the non-performing asset classification down

from >150 days (by 2024) to >90 days (by 2026). This is to be done again via a

glidepath.

The release includes a guideline for capital owned by the NBFCs. The companies are

required to carry out an Internal Capital Adequacy Assessment Process or ICAAP for short as mentioned

under Pillar 2 for Commercial Banks. While it is not insisted upon, it is mandatory for the companies

to carry out realistic ICAAPs. This has been mandated as means to ensure that NBFCs can wade over

risks and develop further in the system.

NBFCs with more than 10 Branches are to adopt Core

Banking Solutions within 3 years starting from 1st October 2022.

The Boards of the NBFCs are

necessitated to delineate roles of their various committees and formulate a calendar of reviews, a

whistle blower mechanism, and ensure good governance.

SPECIFIC TO BL

The NBFCs in the BL layer are now mandated to have a Risk Management Committee to oversee and estimate the exposure of the NBFC and risk faced by it. Apart from this changes to the disclosure have mandated the compulsory inclusion of information pertaining to the capital lent out to directors, their relatives and senior company officers, based on the internal board approved policy.

SPECIFIC TO UL

Depending on the type of business of the NBFC, the board of directors must have relevant experience and expertise. Within 3 of identification, all NBFC-ULs must be listed and comply with the necessary norms. It is mandatory to report the removal/resignation of independent directors, if terminated before the completion of their terms.

SPECIFIC TO UL AND ML

The RBI has changed the credit concentration limit from separate exposure levels for lending and

investment for individuals and groups, by merging them into one. As a result in the case of

individuals, the exposure limit has been set to 25% while in the case of a group the limit is set at

40%, of their Tier 1 Capital.

It is required that NBFCs have an experienced Board that sets

limits on the exposure and ceilings of the capital lent. Any capital lent to commercial real-estate or

exposed to the capital market has been duly classified as Sensitive Exposure and a board determined

internal limit is mandated.

According to the release there are restrictions on loans for the UL

and ML layers, which prevent advances or loans to any director or their relatives, senior officers of

the company, and to borrowers in real-estate who do not possess permission from the local

authorities.

Specifically for the NBFCs belonging to the UL layer, a Large Exposure Framework

is being set up, until the time that such a framework is put in place, board approved internal limits

as mentioned above have been mandated.

Starting 1st October 2022, within a timespan of 2 years it is necessary to ensure that all key

managerial personnel hold no office within the company. Directors to subsidiaries are exempt from this

requirement.

Independent Directors as defined by the Companies Act of 2013 cannot hold board positions in more

than 3 NBFCs at a time. Within 2 years from 1st October 2022 compliance must be ensured and steps must

be taken to avoid conflict of interest.

Starting 31st March 2023, NBFC-ULs are required to disclose corporate governance reports,

modified opinions of the auditors, items of exceptional income and expenditure, Breaches in Terms of

covenants in respect of loans availed and debt securities issued by the NBFC including incidence/s of

default. Divergence in asset classification and provisioning above a certain threshold to be decided

by the Reserve Bank.

UL NBFCs are mandated to appoint a Chief Compliance Officer, a remuneration committee, and decide on principles of fixed/variable pay and malus/clawback provisions.

Those NBFCs classified under multiple layers will be categorised based on their score on the scoring parameters as the case may be.

How FinStack can help?

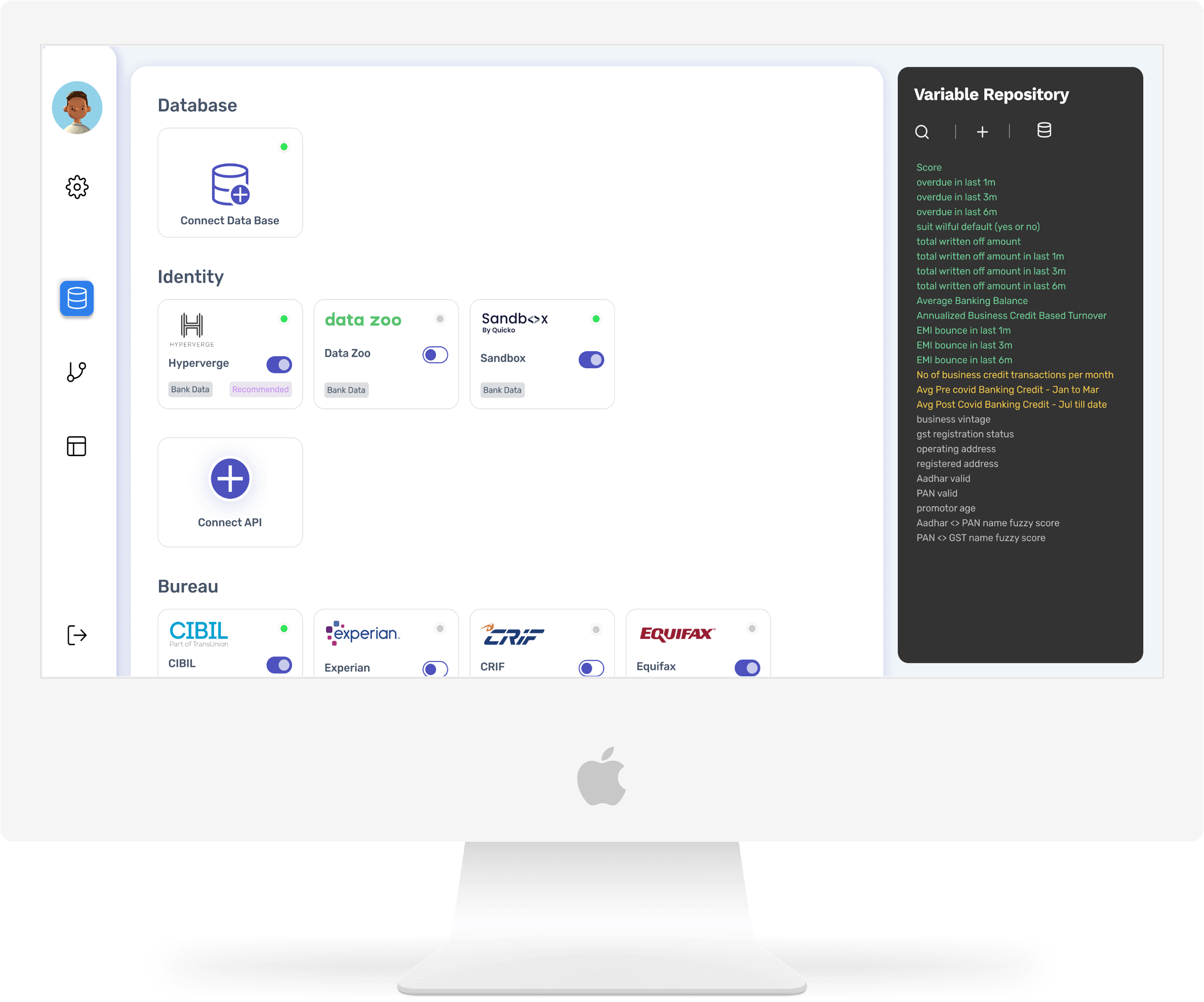

Integrate all the Data points

Connect your data and all third-party integration in under 10 minutes

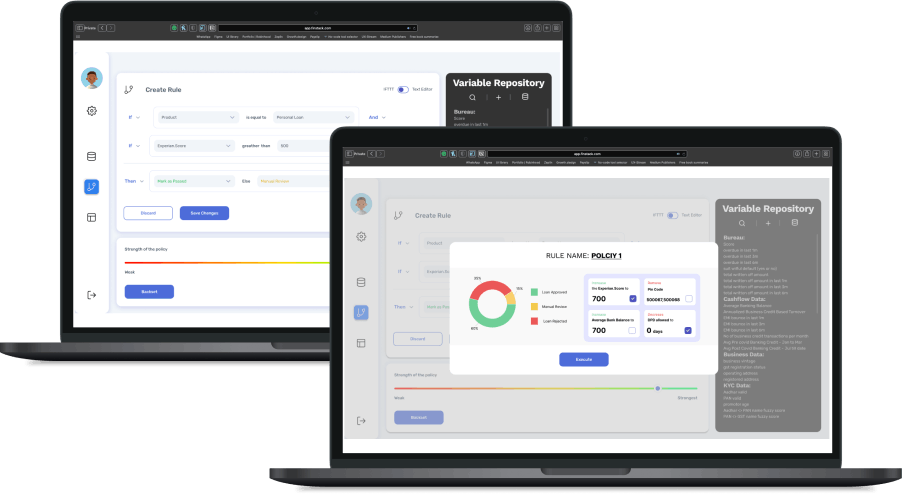

Implement Policies with No-Code

With FinStack's no-code BRE, create, simulate and implement underwriting policies

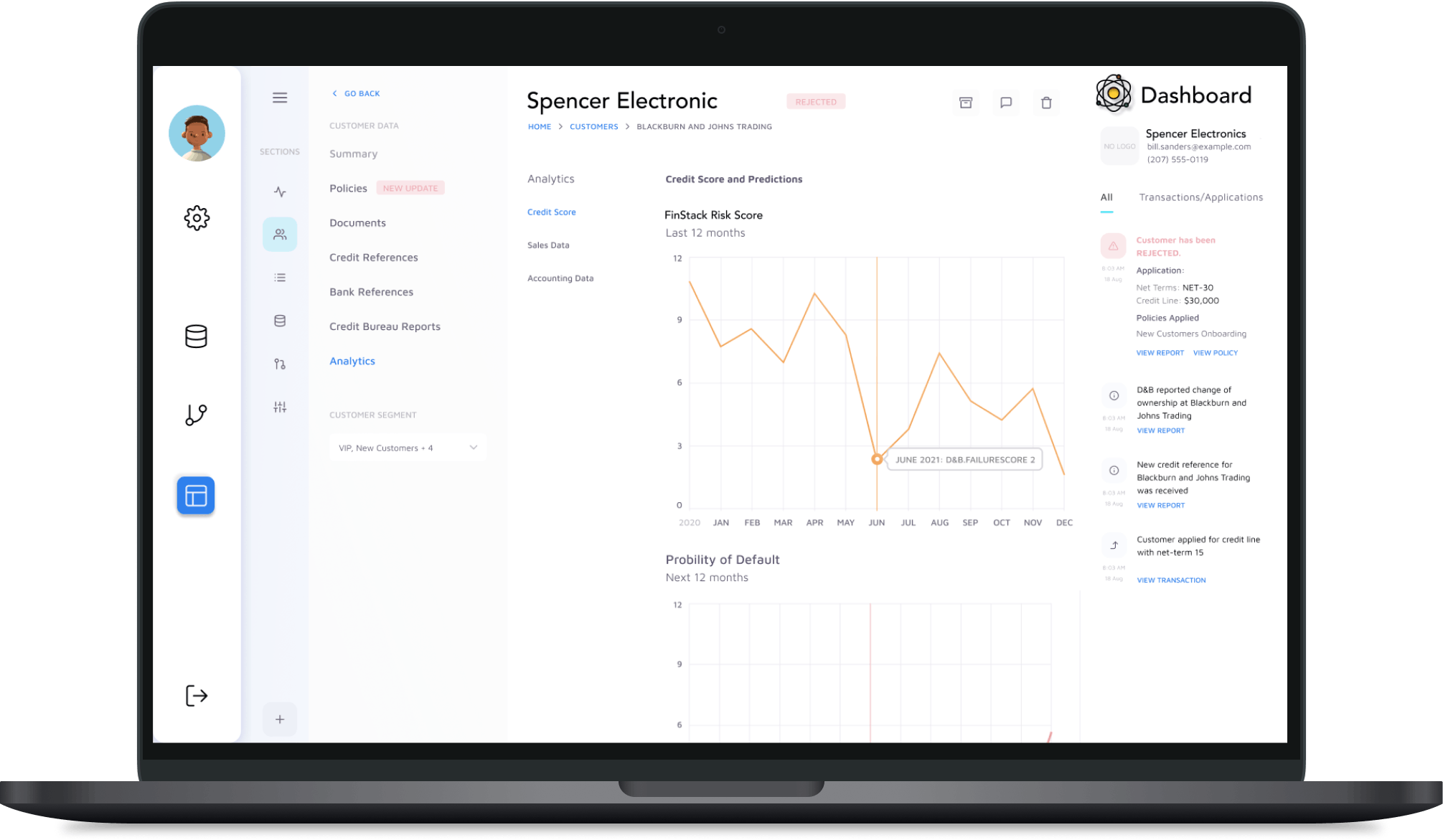

Track Performance of Policies in real-time

Get to know your performance of all the Rules and Policies

Want to work with FinStack?

Drop a message on WhatsApp +91-9158666337